Workers’ compensation includes a series of benefits to compensate employees injured on the job. Understanding the different benefits can help you understand how workers’ compensation works.

Here’s what you need to know.

Health Care Benefits

Workers’ compensation pays 100% of the cost of medical and dental care related to your work injuries. These bills include pharmacy bills, surgical bills, emergency care, follow-up care, and assistive devices.

The only catch is that all care save for emergency care must be given by a health care provider authorized by the Workers’ Compensation Board.

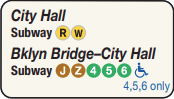

Never pay your health provider for any treatment you receive for work-related injuries or illnesses. You should keep receipts for travel expenses related to your injury, including mileage, public transportation, or other expenses incurred for treatment.

Schedule Loss Benefits

A Schedule Loss of Use Award (SLU) is an additional cash payment to compensate individuals who have permanently lost the use of their eyesight, hearing, or any extremity. Compensation is paid for a specific number of weeks based on the body part and the severity of the disability, minus any temporary benefits paid.

You are only eligible for schedule loss benefits after you reach maximum medical improvement (MMI). You can either have these benefits paid out weekly or have them paid out as a single lump sum.

Non-Schedule Loss Benefits

Non-schedule losses are permanent disabilities to the spine, pelvis, lungs, heart, or brain. When you have a non-scheduled loss, you permanently lose earning capacity.

Benefits are paid out for a minimum of 225 weeks for a loss of capacity of 15% or less and up to 525 weeks for a loss of earning capacity greater than 95%.

Lost Wages

You’re entitled to a portion of your lost wages if your injury keeps you out of work for more than seven days or if your pay gets reduced because you now work fewer hours or do other work for the same employer.

Your employer may also opt to continue paying your wages, though you will not receive money from the insurer if they do.

If you work two jobs, you may be entitled to include both salaries when determining your average weekly wage. The pay rate depends on the degree of your disability, as reported by your doctor.

Survivor Benefits

Workers’ compensation pays survivor benefits to a surviving spouse or minor dependents when a worker gets killed on the job. The amount is ⅔ of the deceased worker’s average weekly wage, paid as a weekly cash benefit.

Workers’ compensation also pays for a funeral or memorial expenses.

Of course, as with all workers’ compensation benefits, there are times when benefits are denied. If that happens, the survivors will generally need help from a workers’ compensation attorney to recover funds.

Get Help Today

If you’ve been injured in a workplace accident and have been denied the benefits rightfully owed to you, don’t hesitate. Contact our office to get help today.

See also:

What is the Difference Between Temporary and Permanent Disability in a NY Workers’ Comp Case?

How Can I Prove My Injury Happened at My New York Workplace?

4 Questions You May Have About Workers’ Compensation